Table of Contents

- Consumer Price Index April 2024 Pdf - Merl Stormy

- Consumer Trends 2024 - Opinion Box

- CONSUMER PRICE INDEX NUMBERS ON BASE 2012=100 FOR RURAL, URBAN AND ...

- Consumer Price Index 2024 Denver Co - Ree Lenora

- Essential Consumer Trends in the Instant Economy 2024 | Brite

- Consumer Trends Report 2024: consumenten blijven voorzichtig, ondanks ...

- Market Outlook Consumer Goods di Indonesia 2013-2024 (Market Growth and ...

- Top Global Consumer Trends 2024 | DoingBusiness.ro

- Consumer Price Index 2024 Philippines March - Daron Emelita

- 2024 Consumer Trends: Navigating Uncertainty - PaperplaneCo

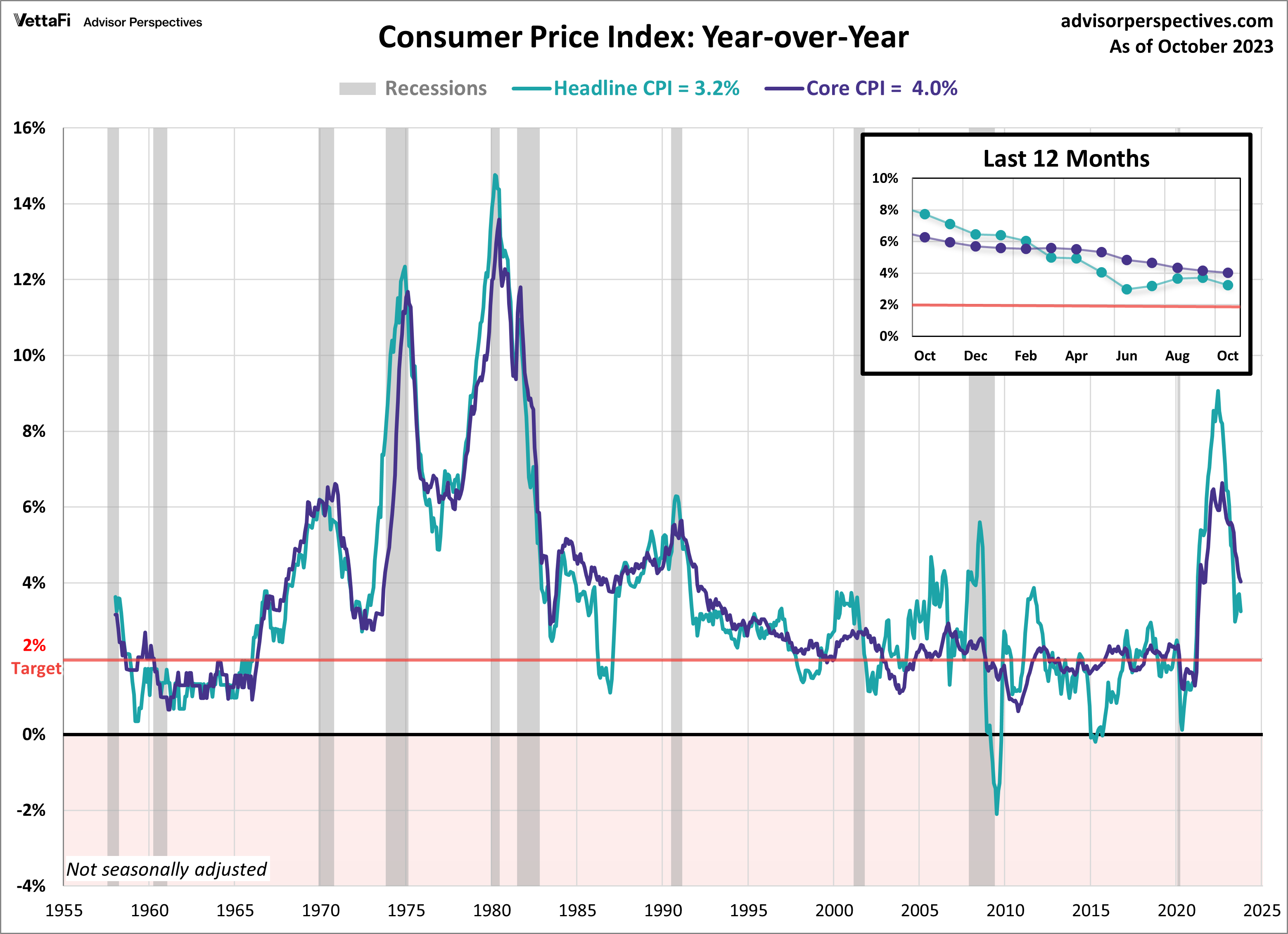

Introduction to Consumer Prices and Inflation

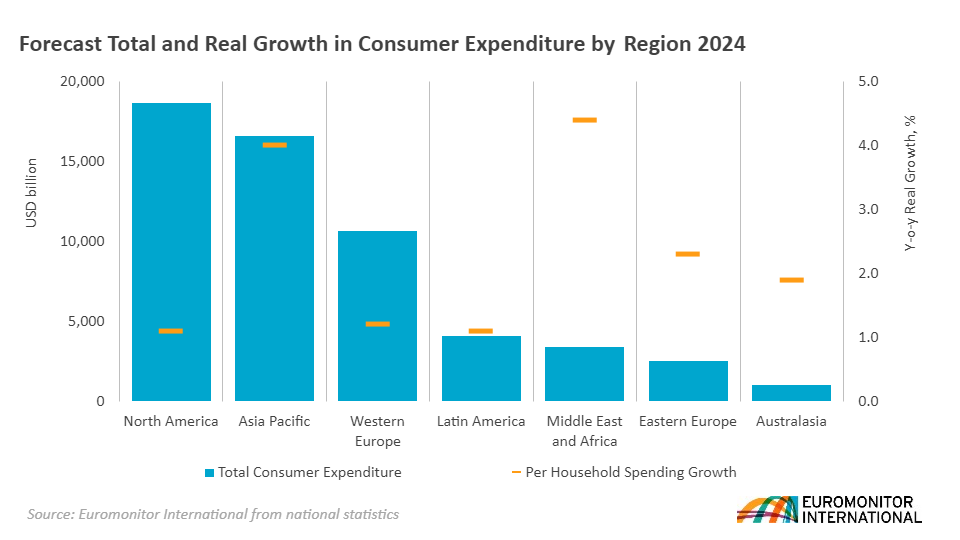

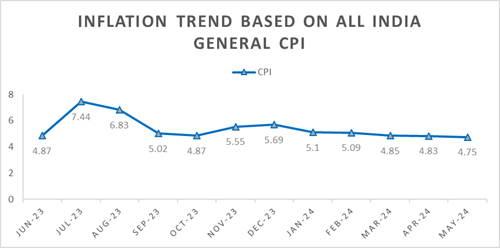

Current Trends in Consumer Prices and Inflation

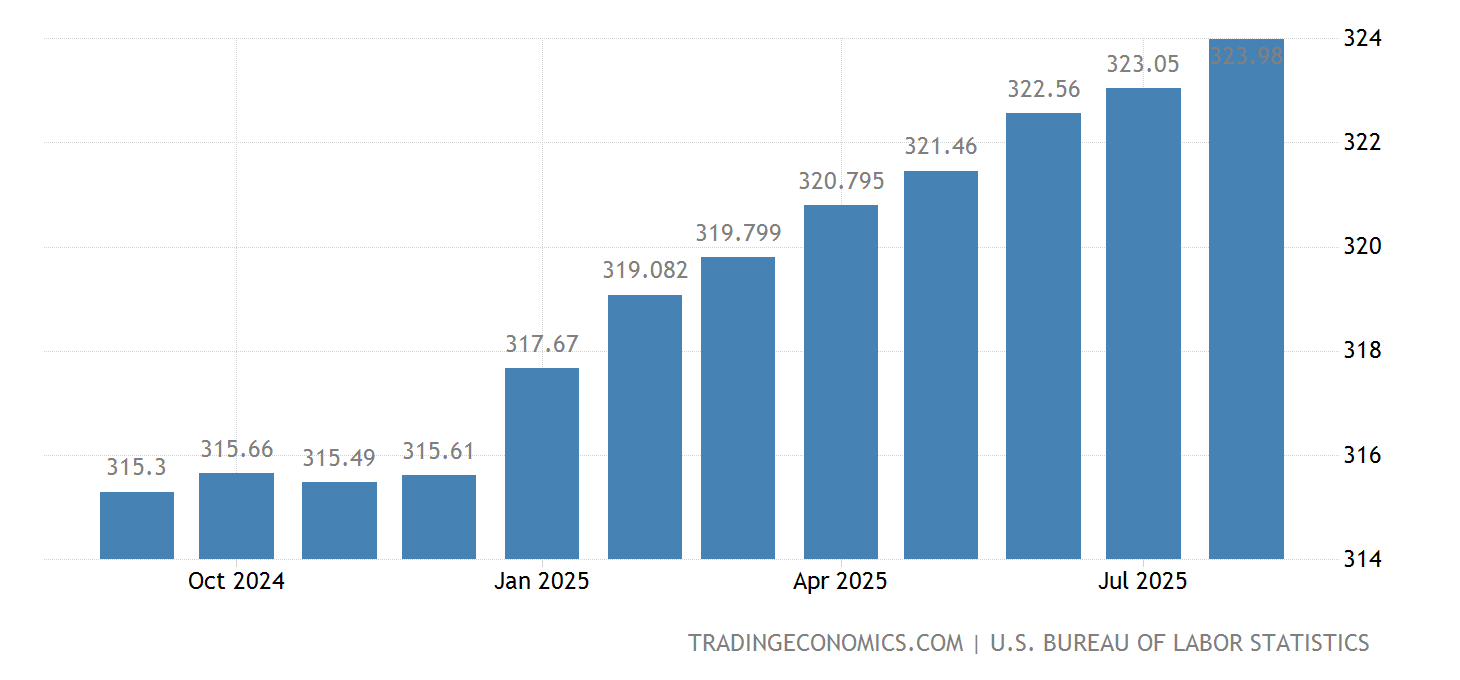

Key statistics include:

- Average Annual Inflation Rate: The average annual inflation rate in the U.S. over the past decade has been around 2%, which is close to the Federal Reserve's target inflation rate of 2%.

- Consumer Price Index (CPI) Growth: The CPI has shown steady growth, reflecting the increase in consumer prices. However, the rate of growth has varied from year to year, influenced by factors such as energy prices, housing costs, and food prices.

- Sectoral Inflation Trends: Different sectors of the economy experience inflation at varying rates. For instance, healthcare costs have consistently risen faster than the overall inflation rate, while the prices of certain consumer goods, such as electronics, have decreased due to technological advancements and global competition.

Impact of Inflation on Consumers and the Economy

Inflation has a dual impact on the economy and consumers. On one hand, moderate inflation can indicate a growing economy with increasing demand for goods and services. On the other hand, high inflation can erode the purchasing power of consumers, particularly affecting those on fixed incomes or with savings that do not earn interest rates keeping pace with inflation.Strategies to manage the impact of inflation include:

- Diversified Investments: Investing in assets that historically perform well during periods of inflation, such as stocks or real estate, can help protect wealth.

- Index-linked Savings: Some savings accounts and bonds offer returns that are linked to inflation, ensuring that the purchasing power of savings is maintained.

- Budgeting and Financial Planning: Consumers can mitigate the effects of inflation by closely monitoring expenses, prioritizing needs over wants, and planning for future price increases.

For the most current data and detailed insights, visiting the official websites of the Bureau of Labor Statistics (BLS) and the Federal Reserve is recommended. These resources provide comprehensive information on consumer prices, inflation rates, and other economic indicators, helping to paint a clearer picture of the U.S. economy's performance and future outlook.