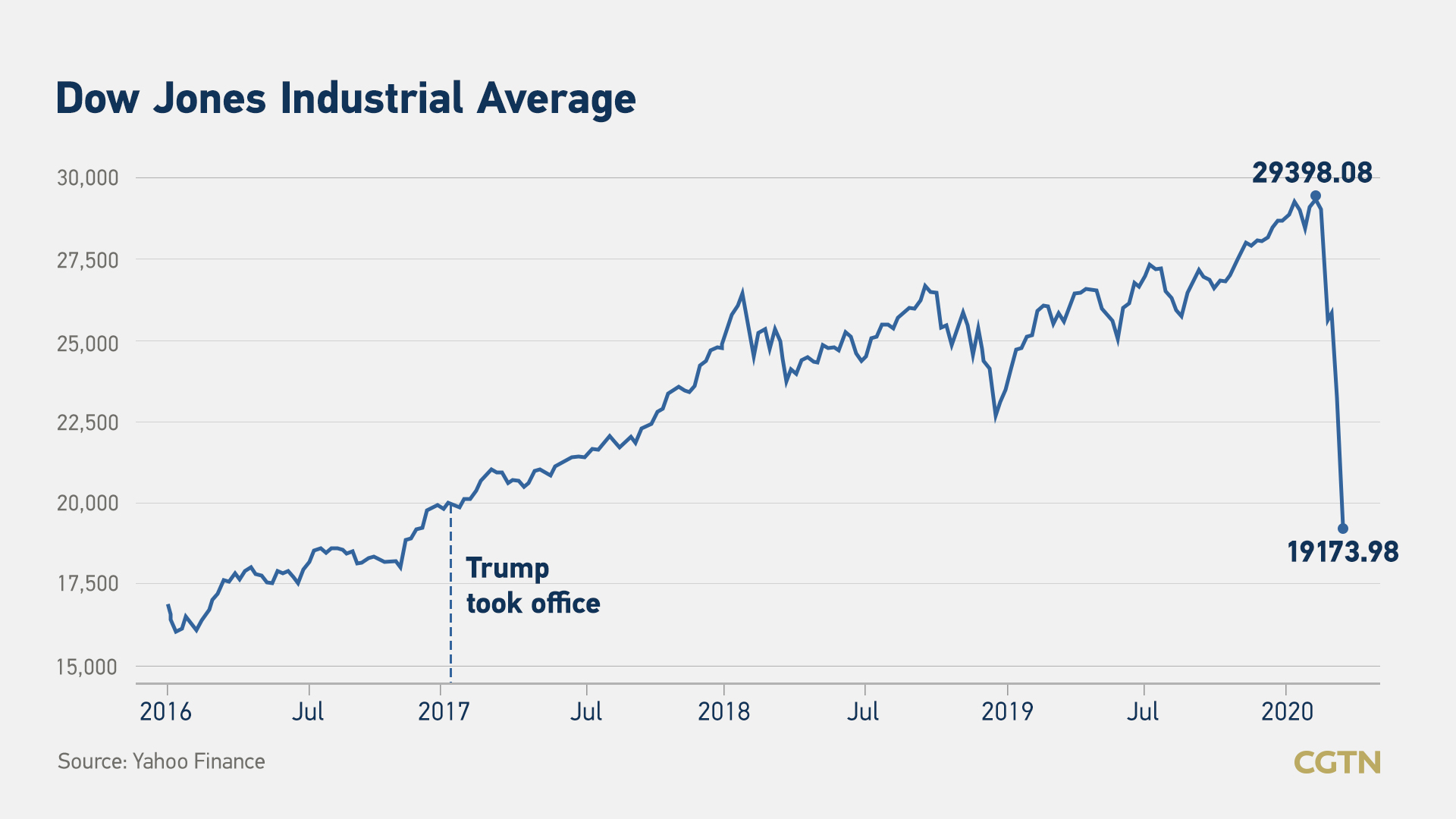

The New York Stock Exchange (NYSE) is one of the world's largest and most prestigious stock exchanges, with a long history of innovation and stability. One of the key mechanisms in place to maintain this stability is the use of market-wide circuit breakers, also known as

circuit breakers. In this article, we will delve into the world of market-wide circuit breakers, exploring what they are, how they work, and their importance in maintaining a stable and orderly market.

What are Market-Wide Circuit Breakers?

Market-wide circuit breakers are rules-based measures that temporarily halt trading across an entire market, or a specific subset of stocks, in response to extreme price movements. These breaks are designed to prevent market volatility from spiraling out of control, giving investors time to reassess their positions and make informed decisions. The NYSE has implemented a set of circuit breakers that are triggered by significant declines in the S&P 500 Index, which serves as a benchmark for the overall market.

How do Market-Wide Circuit Breakers Work?

The NYSE's market-wide circuit breakers are triggered by three levels of decline in the S&P 500 Index:

Level 1: A 7% decline in the S&P 500 Index from the previous day's closing price triggers a 15-minute trading halt.

Level 2: A 13% decline triggers a 15-minute trading halt.

Level 3: A 20% decline triggers a trading halt for the remainder of the day.

These declines must occur within a single trading day, and the trading halts are implemented to give investors time to reassess their positions and make informed decisions.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about market-wide circuit breakers:

Q: What triggers a market-wide circuit breaker? A: A significant decline in the S&P 500 Index, specifically 7%, 13%, or 20% from the previous day's closing price.

Q: How long do trading halts last? A: Trading halts can last for 15 minutes or for the remainder of the trading day, depending on the level of decline.

Q: Can market-wide circuit breakers be triggered multiple times in a single trading day? A: Yes, if the S&P 500 Index experiences multiple declines that meet the trigger thresholds.

Market-wide circuit breakers play a crucial role in maintaining a stable and orderly market. By temporarily halting trading in response to extreme price movements, these mechanisms give investors time to reassess their positions and make informed decisions. The NYSE's circuit breakers are an important safety net, helping to prevent market volatility from spiraling out of control. As the market continues to evolve, it is essential to understand the role of market-wide circuit breakers in maintaining stability and confidence in the financial markets.

For more information on market-wide circuit breakers, including the rules and guidelines governing their use, please visit the

New York Stock Exchange website. By staying informed and up-to-date on market developments, investors can make more informed decisions and navigate the markets with confidence.