Table of Contents

- Irmaa 2026 Brackets And Premiums Chart - Neila Mirabelle

- 2025 Irmaa Brackets Based On 2025 Income Chart - James E. Bono

- 2024 Irmaa Income Brackets - Janel Linette

- IRMAA Income Brackets For 2025: Understanding The Impact On Medicare ...

- Irmaa Brackets 2025 2025 2026 - Adore Carolee

- Irmaa 2026 Brackets And Premiums Chart - Neila Mirabelle

- Irmaa 2025 Part D - Madge Ethelda

- The IRMAA Brackets for 2024 - Social Security Genius

- 2025 Irmaa Brackets Based On 2025 Income Limit - Denna Tamarra

- 2017 Irmaa Chart

2024 Income Tax Brackets

- 10%: $0 to $11,600 (single) and $0 to $23,200 (joint)

- 12%: $11,601 to $47,150 (single) and $23,201 to $94,300 (joint)

- 22%: $47,151 to $100,525 (single) and $94,301 to $201,050 (joint)

- 24%: $100,526 to $191,950 (single) and $201,051 to $383,900 (joint)

- 32%: $191,951 to $243,725 (single) and $383,901 to $487,450 (joint)

- 35%: $243,726 to $609,350 (single) and $487,451 to $731,200 (joint)

- 37%: $609,351 and above (single) and $731,201 and above (joint)

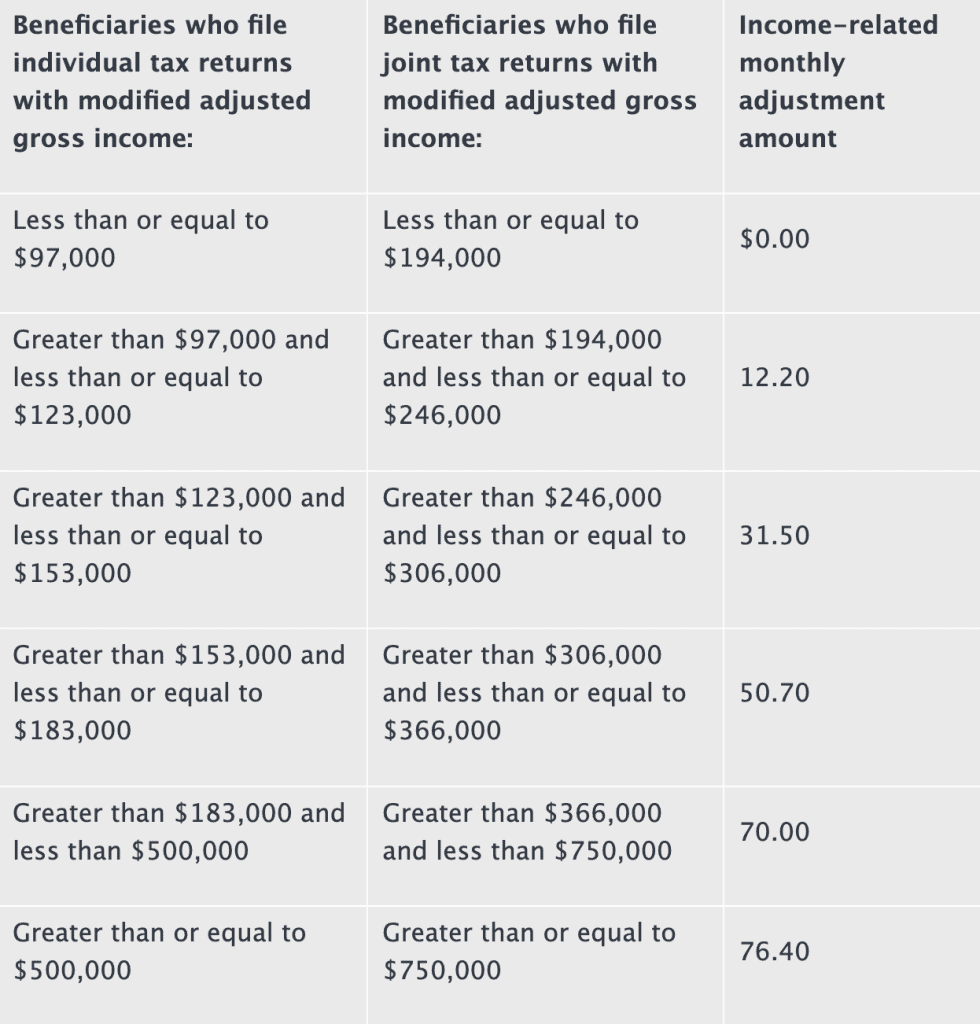

IRMAA Brackets for 2026

- Individuals with incomes between $97,000 and $123,000 will pay a surcharge of $65.90 per month

- Individuals with incomes between $123,001 and $153,000 will pay a surcharge of $159.30 per month

- Individuals with incomes between $153,001 and $183,000 will pay a surcharge of $252.70 per month

- Individuals with incomes above $183,000 will pay a surcharge of $346.10 per month

Source: Intuit

Note: The information provided in this article is subject to change and may not reflect the most up-to-date information. It's essential to consult with a tax professional or the IRS website for the most accurate and current information.