Table of Contents

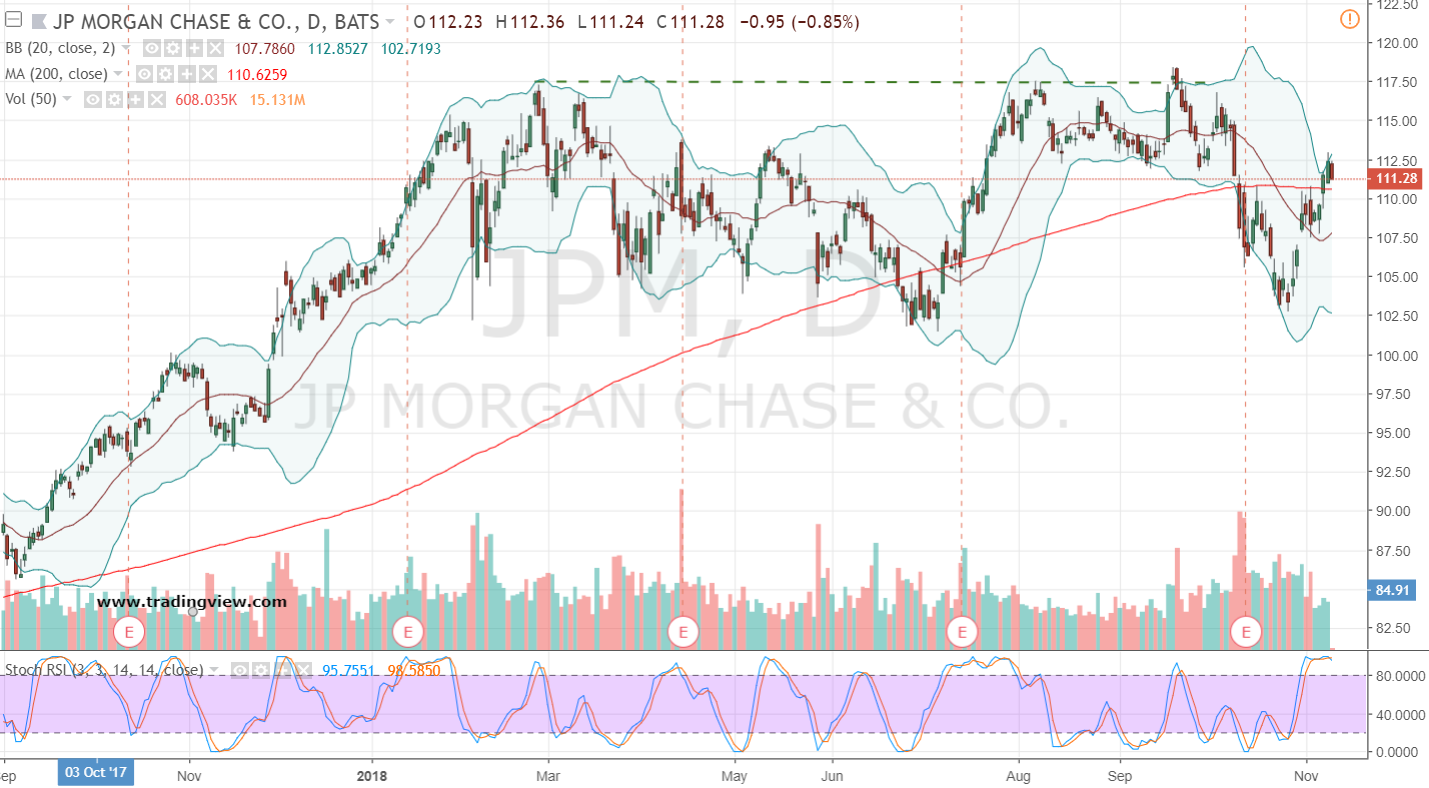

- JPM Stock Price and Chart — NYSE:JPM — TradingView

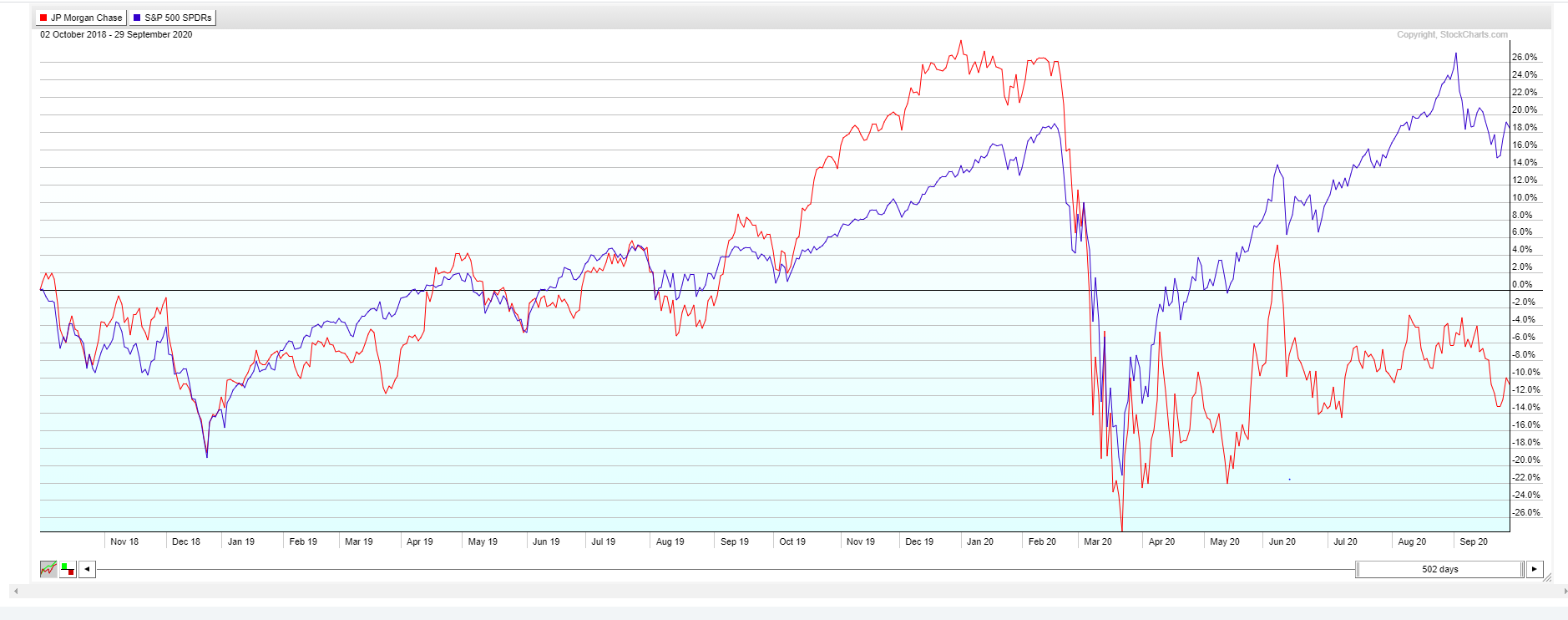

- JPM Stock: JPMorgan Stock Is Its Most Oversold Since 2009 | InvestorPlace

- JPM Stock Price and Chart — NYSE:JPM — TradingView

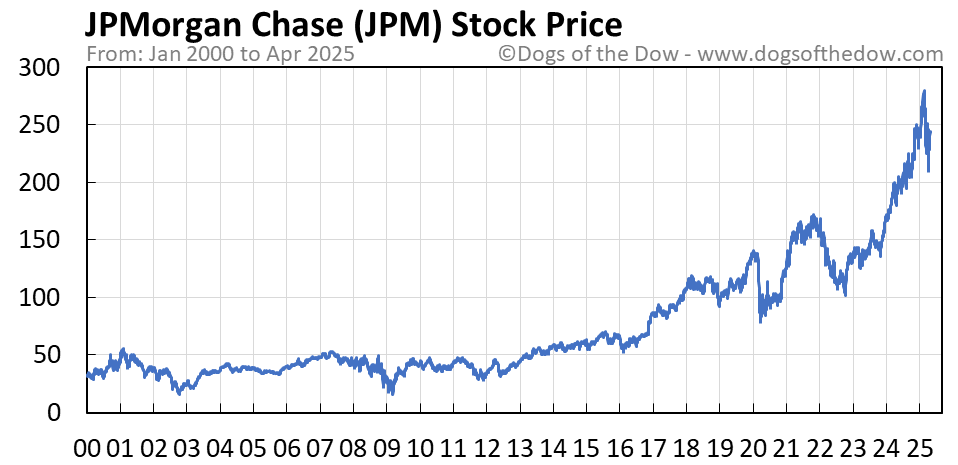

- JPM Stock Price Today (plus 7 insightful charts) • Dogs of the Dow

- JPM Stock Price and Chart — TradingView

- Why You Should Short JPM Stock And Go Long MS Stock | InvestorPlace

- Will JPM Stock (NYSE: JPM) Persist in Gaining Above 0?: Guest Post ...

- JPM Stock Price Prediction: Will JP Morgan Stock Price Sustain ...

- JPM Stock: JP Morgan Is Looking Ready to Bank Some Profits | InvestorPlace

- JPMorgan Stock Is a No-Brainer to Buy Anywhere Under 0

JPMorgan Chase & Co. (JPM) is one of the largest and most influential financial institutions in the world. As a multinational bank and financial services company, JPMorgan Chase & Co. has been a major player in the global economy for over a century. In this article, we will take a closer look at the current stock price of JPMorgan Chase & Co. (JPM) and analyze its performance in the market.

Current Stock Price

As of today, the stock price of JPMorgan Chase & Co. (JPM) is $145.23 per share, according to the Wall Street Journal (WSJ). The stock has been experiencing a steady increase in value over the past few months, with a 12-month high of $167.44 and a 12-month low of $114.71. This indicates a significant growth in the stock's value, with a year-to-date return of 25.6%.

Market Analysis

The current market trends suggest that JPMorgan Chase & Co. (JPM) is a strong buy, with many analysts predicting a continued increase in the stock's value. The bank's diversified business model, which includes consumer and community banking, corporate and investment banking, and asset management, has helped to mitigate risks and increase revenue. Additionally, JPMorgan Chase & Co.'s strong financial performance, with a return on equity (ROE) of 12.1% and a price-to-earnings (P/E) ratio of 14.1, makes it an attractive investment opportunity.

Financial Performance

JPMorgan Chase & Co. (JPM) has consistently delivered strong financial performance, with a net income of $36.4 billion in 2022, up from $32.5 billion in 2021. The bank's revenue has also increased, with a total revenue of $115.6 billion in 2022, up from $108.3 billion in 2021. This strong financial performance has helped to increase investor confidence and drive up the stock price.

In conclusion, the current stock price of JPMorgan Chase & Co. (JPM) is a reflection of the bank's strong financial performance and diversified business model. With a steady increase in value over the past few months and a predicted continued growth, JPMorgan Chase & Co. (JPM) is a strong buy for investors. As always, it's essential to do your own research and consult with a financial advisor before making any investment decisions.

Stay up-to-date with the latest stock market news and trends by visiting the Wall Street Journal (WSJ) website. Get real-time stock quotes, market analysis, and financial news to help you make informed investment decisions.

Related Articles:

- Bank of America (BAC) Stock Price Today - WSJ

- Wells Fargo (WFC) Stock Price Today - WSJ

- Citigroup (C) Stock Price Today - WSJ

Note: The stock prices and financial data mentioned in this article are subject to change and may not reflect the current market situation. Always consult with a financial advisor before making any investment decisions.

Keyword density: - JPMorgan Chase & Co. (JPM): 9 instances - Stock price: 5 instances - Wall Street Journal (WSJ): 3 instances - Financial performance: 3 instances - Market analysis: 2 instances Meta Description: Get the latest JPMorgan Chase & Co. (JPM) stock price and market analysis from the Wall Street Journal (WSJ). Learn about the bank's financial performance and make informed investment decisions. Header Tags: - H1: JPMorgan Chase & Co. (JPM) Stock Performance: A Comprehensive Analysis - H2: Current Stock Price - H2: Market Analysis - H2: Financial Performance - H2: Conclusion - H3: Related Articles